|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring the Best No Cost Refinance Rates for Your HomeRefinancing your home can be a great way to take advantage of better interest rates and save money over time. But what if you could do it without any upfront costs? That's where the concept of no cost refinance comes into play. Understanding No Cost RefinanceNo cost refinance essentially means that the lender covers the closing costs associated with refinancing your home loan. These costs are typically included in the loan balance or slightly higher interest rates. How Does It Work?The lender pays the closing costs, which can include appraisal fees, credit report fees, and title insurance, among others. In exchange, you may agree to a higher interest rate than you would with a traditional refinance. Pros and Cons

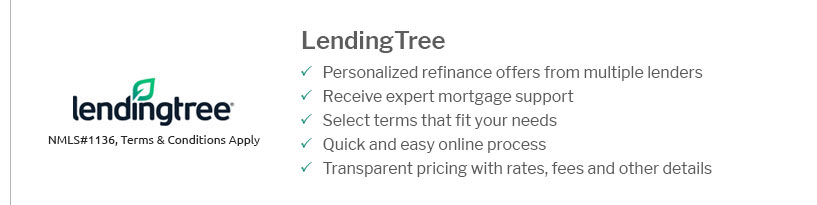

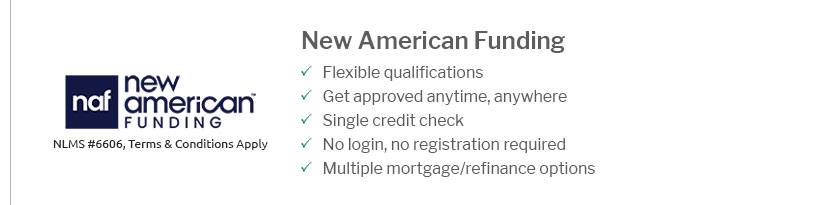

Finding the Best RatesResearching and comparing different lenders is crucial to finding the best no cost refinance rates. Websites like home buying interest rates today provide valuable insights into current market trends. Top Tips for Securing a Good Rate

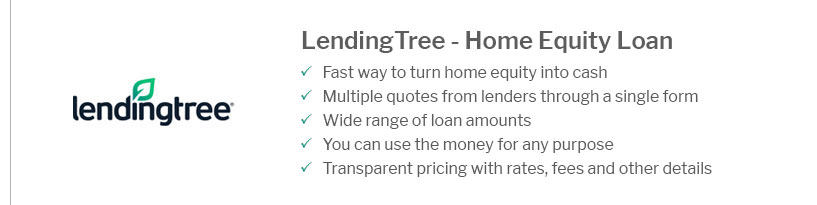

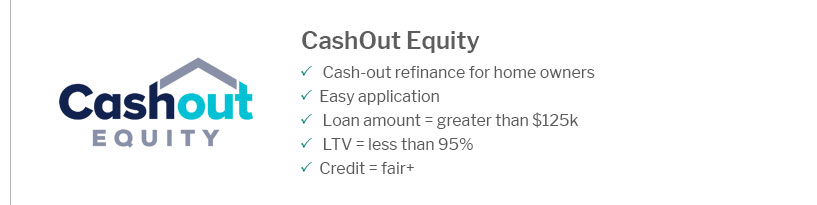

Alternatives to No Cost RefinanceIf a no cost refinance doesn’t suit your needs, consider other options such as working with high risk mortgage lenders who might offer different refinancing solutions. Traditional RefinanceWith traditional refinancing, you pay closing costs upfront, which might lead to lower interest rates compared to no cost options. Cash-Out RefinanceThis option allows you to refinance your mortgage for more than you currently owe and take the difference in cash, potentially useful for home improvements. Frequently Asked Questions

https://www.bankrate.com/mortgages/refinance-rates/

30 year fixed refinance. Points: 1.683. 8 year cost: $303,821. 5.744%. 30 ... https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

No-closing-cost refinance. Refinancing a loan is no small expense. If you don't have some cash set aside for the closing costs, you may want to ...

|

|---|